Boycott Economics

Hi friends,

Over the past few weeks, I’ve talked about the harm done to consumers by a strained electric grid, increased market concentration, and the overall lack of a plan by this Administration. But this week, as we all tried to grapple with another public murder at the hands of the federal government—followed up with lies from the White House and no guarantees for a just investigation—we were also reminded about the power we hold as American consumers. Spending power across income groups is disproportionate (as I’ve also discussed!), but every consumer has a degree of agency over when and where to spend. As we’re seeing around the country, and indeed, around the world, boycotts can be an effective weapon. A pause in spending is a pause in growth—an economic repercussion that gets the attention of any policymaker.

Read on—just one chart and 758 words.

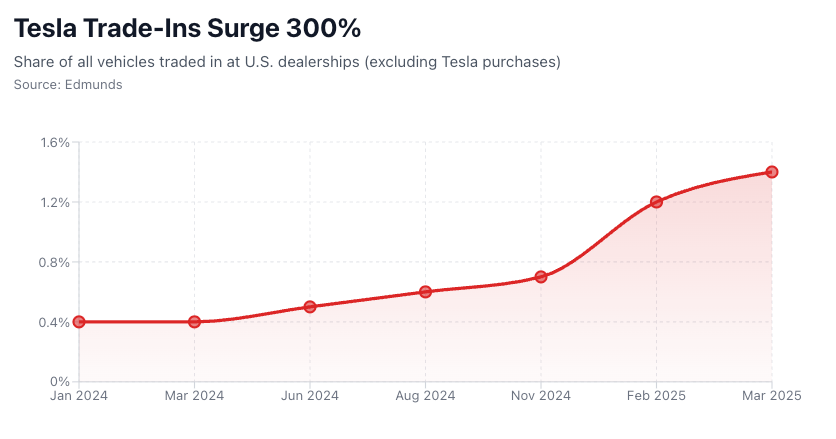

Chart of the Week: Starting in 2025, consumers nationwide and across more than 250 cities worldwide launched the “Tesla Takedown” in protest of Elon Musk. As Tesla owners rushed to dump their vehicles—trade-ins surged 300% year-over-year, hitting an all-time high. On Wednesday, Tesla reported its first-ever annual revenue decline and a 61% drop in net profit for Q4:2025.

American consumer power

For centuries, consumer boycotts—an attempt “to achieve certain objectives by urging individual consumers to refrain from making selected purchases in the marketplace”—have been a way for people to use their consumer power. From the mid-20th century onward, boycotts have become more frequent and targeted.

In response to nearly eight weeks of ICE’s “Operation Metro Surge” immigration enforcement in Minnesota, a coalition of local organizers called for an economic blackout.

This isn’t the first Trump-era consumer boycott.

In February 2025, People’s Union USA called for a widespread boycott across essential and nonessential industries in protest of (a) President Trump stacking federal agencies with billionaire leadership and (b) retailers—like Walmart, Target, and Nestlé—who almost immediately rolled back DEI practices in response to administration demands.

In December 2025, over 220 organizations and 40,000 Americans pledged to participate in a boycott to avoid holiday purchases at Trump-aligned companies including Spotify, Target, Amazon, and Disney.

While public announcements allow markets to anticipate blackouts and businesses to adjust prices, research finds pivotal bottom-line implications.

Across consumer boycotts in the 1970s, in the two months following boycott announcements, the market value of targeted firms dropped over $120 million relative to pre-boycott market value.

Within 30 days of the 1974 sugar boycott, stock prices of the four primary sugar firms faced a decline of over 30% relative to expectations.

Even after controlling for broader economic conditions and other factors, an analysis of 127 boycotts from 1978 to 2017 finds that the mere threat of an economic boycott coincides with significant declines in shareholder wealth.

In case you missed it: This week, the Federal Reserve held interest rates at 3.5 to 3.75 basis points, with Stephen Miran and Christopher Waller dissenting in favor of President Trump’s demands to cut rates further.

After months attacking Jerome Powell, President Trump has nominated Kevin Warsh as the next Federal Reserve Chair. I joined Bloomberg’s “Balance of Power” to discuss this further, underscoring that limiting the Fed’s independence could be dangerous for future monetary policy.

State-level action

Georgia: In 2021, Governor Brian Kemp passed the Election Integrity Act, increasing voter ID requirements that disproportionately hit voters of color. Consumers pushed companies like Home-Depot (which employs 129,500 statewide and contributes nearly $3.5 billion to state GDP), Delta, and Coca-Cola to denounce the law. Meanwhile, the MLB moved the “All-Star” game out of Atlanta, costing Cobb County $100 million in tourism revenue.

North Carolina: In 2016, lawmakers passed House Bill 2, widely viewed as limiting LGBTQ protections. Consumers pushed back, and corporations like Adidas, PayPal, and Deutsche Bank halted plans to expand in the state (Paypal’s retreat alone cost state and local initiatives over $3.5 million in investment and 400 jobs). Along with consumers, over 400 businesses and organizations “boycotted” the state, resulting in an estimated economic loss of nearly $3.8 billion over the next 12 years.

Arizona: In response to SB 1070, which allowed local law enforcement to enforce federal immigration law, national organizations canceled meetings and conferences throughout the state, causing an estimated loss of $141 million in spending. Over the next 2-3 years, cancellations resulted in 2,800 intended jobs lost, over a quarter billion dollars in economic output, and more than $86 million in lost wages. Councils in cities like Los Angeles banned future contracts with Arizona businesses and nonessential travel to the state.

Economic boycotts can affect change. Despite the attacks on our healthcare, childcare, food security, and education (the list goes on!), the economy doesn’t thrive without American consumers. In this time of constant chaos, remember we are many, they are few.

Best,

Heather

Thank you! I greatly appreciate the information you post.

Another example is the flight of tourists who are choosing to "boycott" the U.S.

International arrivals to the US are down by double digit figures over the last year.

And "Buy Canada" initiatives are a boycott of sorts, driven my discontent and distrust in response to threats of annexation.