The GOP’s July 4th Gift to Billionaires

Hello! I hope you’re gearing up for a long (hopefully not too hot) holiday weekend. I’ll be getting in the spirit by attempting to jumpstart our new BBQ grill and celebrate accordingly. But before I do, I wanted to share a few thoughts on this week’s economic news. Needless to say, this has been a jam-packed week, in no small part because it started over the weekend with amendments going through the night in the Senate and ended with an epic speech by Leader Jefferies.

As I laid out on Monday, I’m very concerned about the impacts that the newly passed Republican budget bill will have on our economy. At a time when Americans are urging the President and Congress to lower costs, the bill kicks millions of Americans off Medicaid, slashes nutrition assistance, and guts clean energy programs. As a result, the cost of health care, groceries, and utility bills will skyrocket while billionaires get a very big tax giveaway.

Yesterday I had the opportunity to talk through the implications of the GOP budget bill with Jess Craven. If you missed it, check it out HERE.

Please read on for the Chart of the Week and more details on the week’s economic news.

Chart of the Week

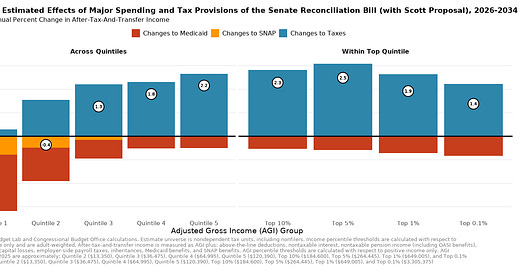

After the passage of the Republican budget bill, the top 5% will see a 2.5% increase in after-tax-and-transfer income, while the bottom 40% will see a decline.

Diving into the week’s economic news

This morning, the Bureau of Labor Statistics released employment data for the month of June, showing total nonfarm payroll employment increased by 147,000, while the unemployment rate held steady at 4.1 percent. Healthcare added 39,000 jobs, and job gains occurred in hospitals (+16,000) and in nursing and residential care facilities (+14,000). This growth is likely to sharply decline in wake of Medicaid cuts, which threaten funding to hospitals care facilities.

The Republican budget bill provides $4.5 trillion in tax breaks, mostly to those at the top of the income ladder, adding $3.3 trillion to the deficit and causing a 2.9% decline in income for those at the bottom of the income distribution. This is the largest transfer of income from the bottom to the top in any law in US history. By making a significant amount of the Tax Cuts and Jobs Act permanent, we’re asking low-income and middle class families to shoulder the burden – again.

This bill makes $1 trillion in cuts to Medicaid, which, combined with other administrative actions, will mean that nearly 17 million people are at risk of losing coverage. Medicaid is an essential funding stream for rural and safety-net hospitals, now putting 338 rural hospitals at risk of closure and making the critical source of employment and immediate care in these communities out of reach.

The bill phases out many of the Biden-era clean energy tax credits and includes provisions that will likely weaken clean energy industries by placing difficult, if not impossible-to-meet bureaucratic rules on their supply chains.

National parks, national forests, wildfire refuges, wilderness and recreation areas, and more will see a 35% decrease – about $4 billion – in federal funding compared to 2024. There has been an estimated 16.5% drop in National Park Service staff since 2023, and the further staff cuts would create a ratio of one public lands staff member per 16,000 visitors.

A provision in the bill extends an upside down student loan tax break that disproportionately benefits high-income workers. With eligibility for the break hinging on employer sponsorship of a repayment plan, 40% of beneficiaries fall in the top 25% of compensation distribution, and 20% fall within the top 10%.

What this looks like on the ground

Alaska: Federally funded SNAP benefits prevent hunger for over 20,000 households in Alaska – 49% of which have children – while Medicaid provides coverage for one in three. The Republican budget bill will shift Medicare federal funding of $190 million per year onto the state.

West Virginia: The combination of the bill’s near termination of President Biden’s SAVE plan, a harsher cap on Parent PLUS loans, and a phase out of grad PLUS loans students in West Virginia, a state with one of the lowest college affordability indexes, are likely to find it hard to borrow to pay for higher ed.

Iowa: Despite Senator Joni Ernst’s amendment, the phaseout of clean energy tax credits largely remains – a requirement that could disproportionately impact Iowa, which generates nearly 60% of its electricity from wind.

Thanks for reading! We’re just starting up, so let me know what you like and what economic issues you’d like to learn more about. The plan is to post this newsletter every Friday, with occasional just-in-time missives. For now, enjoy your long weekend – I’m guessing we all could use a break!

Best,

Heather

I appreciate your willingness to help those of us outside the field of economics stand on more solid ground as we discuss the impacts and probable outcomes of this bill with our neighbors and colleagues. If we hope to change people’s minds our arguments must be clear and relevant for the person we’re speaking with. In that regard, I don’t yet feel like I’m close.

As you have time, I’m looking forward to some deep dives into each of the major issues with this bill. Maybe breaking it down into its main components; medical, education, energy and employment. I’m likely missing some important areas.

Regarding this post, the sentence, “This is the largest transfer of income from the top to the bottom..”, should read bottom to top.

If readers want a direct link to the 338 rural hospitals mentioned in the post, the list can be found here:

https://www.ismanet.org/pdf/Medicaid-2025-Rural-Hospitals-Data.pdf

While it may be more difficult to quantify the impact on medical clinics serving families in the lower financial quintiles, the effect on these facilities will be exponentially more devastating. It’s heartbreaking.

I think you’ll build a smart, robust community here. All the best.