Forfeiting Our Future: Economic Implications of Failing to Show Up

Hi friends,

While the Trump administration faces self-inflicted economic challenges at home—ending the longest-ever government shutdown and the now impending healthcare crisis—the world’s attention is on how to shape future economic growth. In Brazil, nearly 200 nations are meeting at the United Nations’ 30th Climate Change Conference (COP30). President Trump withdrew the United States from the Paris climate agreement for the second time, making the United States one of only four countries sitting out of COP30. While the President refers to climate change as the “greatest con job ever perpetrated,” other countries are understanding how clean energy not only lowers emissions, but is a pathway to energy security and, in turn, economic growth. COP30 is fast becoming a convening of nations devising strategies for economic development and security, and the United States is absent.

Read on—just one chart and 759 words.

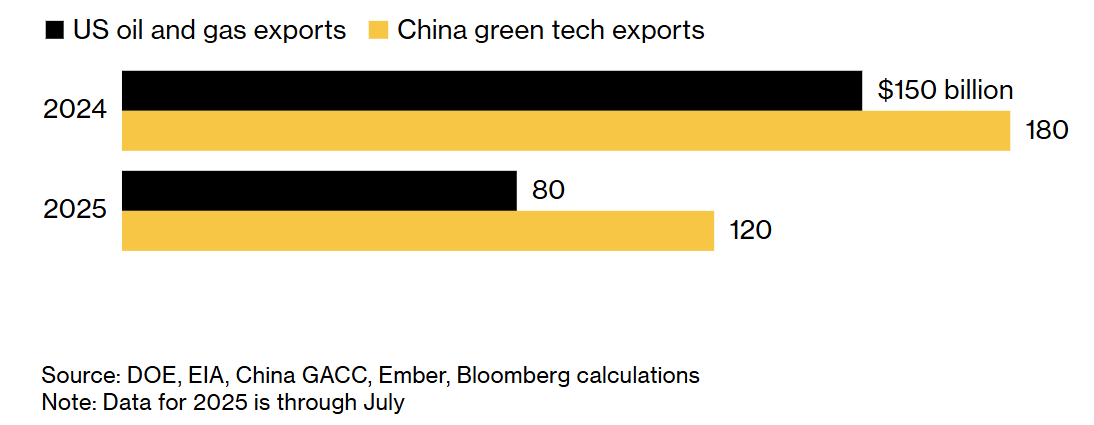

Chart of the Week: The green-energy market is an opportunity for economic growth. In 2024, The United States earned $150 billion in oil and gas exports, while China earned $180 billion from exporting clean energy technologies. In Q2:2025, domestic electric vehicle sales in China outpaced all vehicle sales in the United States.

Other countries are pulling ahead, while we fall behind

Despite President Trump issuing a series of threats to attendees if they support a climate pact—including blocking ports and restricting visas—nations are scaling up their efforts to develop their own energy security.

At COP30, China is flexing its role as a global leader in technologies that matter. Chinese firms control 80% of the world’s solar manufacturing supply chain and, by 2030, are on track to control 60% of all renewable capacity.

China’s pace of solar production is a net positive, but allowing one nation to dominate a market—and the market price—presents domestic and global risks.

Developing nations are demonstrating how clean energy can power economic growth by leapfrogging old technologies—and many are doing so by partnering with China.

Nigeria has partnered with LONGi—the world’s largest solar production company, headquartered in China—to build the country’s first-ever solar plant.

Nearly 76% of all new passenger vehicles in Nepal are now electric, and over 75% of their imported vehicles come from China. Ethiopia is the first country to introduce a complete ban on the import of combustion engine vehicles, seeking to leapfrog over old technologies.

In contrast: the Trump administration has canceled over $7.5 billion in energy projects this year alone, derailing $14 billion in clean energy investments.

The Energy Department canceled a $4.9 billion loan guarantee for Grain Belt Express, an $11 billion, 800-mile ultrahigh-voltage line carrying power from wind farms in Kansas to Illinois and Indiana, also set to create 20,000 temporary jobs.

Underinvestment leaves American households relying on outdated infrastructure that increases energy bills, competing for grid space, and attempting to keep up with a budding trade war.

Absence on the world stage underscores disregard for the domestic macroeconomic risks of relying on fossil fuels. President Trump’s Treasury Department dismantled the Climate-Related Financial Risk Advisory Committee—established to assess these threats—claiming that climate is not a financial risk. But the data says otherwise.

In 2022, the insurance industry recorded a net underwriting—meaning companies paid out more in claims than they received in premiums—of nearly $27 billion. In 2024, for the first time since 2010, homes in the United States considered low-risk in three major climate categories gained value faster than high-risk homes.

Unless mitigated, by the end of the century climate-related financial risks are estimated to impose annual federal revenue losses of 7.1% and reduce GDP by up to 10%. Now is the time to incorporate the risks of climate damages and opportunities of building a clean economy into our economic forecasts, not put our head in the sand.

Slow growth on the ground

Alaska: The Trump administration reopened the Arctic National Wildlife Refuge—one of the largest remaining U.S. wilderness tracts—to oil drilling even though the economics aren’t in favor of more drilling. When President Trump lifted the ban in 2017, the Interior Department projected $2 billion in royalties from land sales, but in fact, the total was an eighth of that ($14.4 million). The January 2025 auction did not garner a single bidder.

Washington: American communities need a viable energy plan. Next year, the Greater Northwest will face an energy deficit of 1,300 megawatts—enough to power roughly 1.4 million homes. By 2030, this deficit—due to both increasing construction of AI data centers and a lack of new energy sources and transmission lines—will climb to 9,000 megawatts.

Illinois: Once signed by Governor Pritzker, the newly passed Illinois’ Clean and Reliable Grid Affordability Act will establish a three-gigawatt solar goal and create Virtual Power Plant and Time-of-Use programs. It will also require Project Labor Agreements for community-solar projects three megawatts and larger, following the example of Biden administration requirements for large-scale projects, which in February 2025 were swiftly removed by the Trump administration.

Disregarding the clean energy race confines the United States to the margins during conversations about innovation, industrial strategy, national security, and worldwide supply chains. The American people will bear the cost of the United States’ absence, not our allies.

Best,

Heather

The data on China's dominace in clean energy is really eye opening. It's striking how quickly they've scaled up renewables while the US pulls back on critical investements. Missing COP30 sends a mesage that we're opting out of the growth opportunitys other nations are pursuing. The link between enegy security and economic growth is imposible to ignore, especialy when clean energy exports are outpacing fossil fuel revenue in some areas.